If you sell insurance, financial services to women, as well as health care solutions, you need to be a consultant, educator, confidante, friend, and, most importantly, a trusted professional advisor.

If you sell insurance, financial services to women, as well as health care solutions, you need to be a consultant, educator, confidante, friend, and, most importantly, a trusted professional advisor.

There is one quick item to point out. Why are health care decisions so important today? One reason is that several studies have confirmed that workers place health care benefits near the top of the list of reasons in choosing their future employer. Due to escalating health care costs, benefits to offset these costs are considered to be of vital importance.

Let’s look at one interesting example. The Affordable Care Act initiated new compliance laws. These laws mandate that companies educate every employee on the health care services it provides. Previously, some companies felt that employees were never interested in seeing presentations from insurance companies to learn about the major medical or supplemental insurance plans they offered. Their human resources staff would just ask employees if they were interested in enrolling in the plans they provided. Many people would decline, simply out of frustration at the lack of knowledge provided by the companies. (Read on for a real-world example of this.)

Today, the Affordable Care Act requires all companies to clearly educate their employees about the health care insurance programs that it provides. This is now mandatory for companies to be considered in compliance with the new laws. If an employee does not want to enroll, they must sign a “waiver,” declining coverage.

Why had this specific issue become so important? Previously, companies would accept a verbal “no” from employees after the company gave a quick overview of the insurance options it provided. Later, employees who said “no” and experienced serious health issues such as cancer, heart attack, stroke, and other health conditions would be very upset that their company did not fully educate them on the programs they provided. Today, the company must fully educate their employees, and if an employee declines, they must get a signed “waiver” declining coverage.

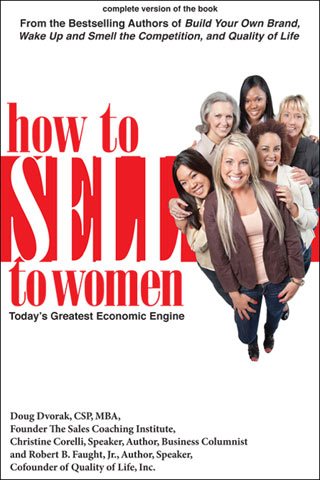

The new book on Selling to Women – Today’s Greatest Economic Engine uses real-world stories to demonstrate the impact women have in purchasing and making financial decisions. Here is just one story from the book that depicts key points on how to sell financial services to women.

Selling Health Care and Financial Services to a Female HR Director

“Employees are never interested in seeing a presentation from an insurance company to learn about health care insurance, financial planning or investments.”

Joe, a highly successful insurance agent and financial advisor for a major firm, heard those words from an HR director. He shared this experience with the writers of this book and stated that knowing how to sell to women and having the ability to establish trust and rapport helped him to dramatically increase his sales:

“My predecessor had been working the account for over six years with little results. The client was a Director of Human Resources, a female client whose company offered supplemental insurance to their employees.

When his predecessor had the account, The HR Director never encouraged employees to attend a presentation. She would simply ask new employees if they wanted to hear a presentation on supplemental insurance and financial services. Employees would always refuse. To make matters worse, when questioned by an executive (also a woman), the HR Director would simply state, “Employees are never interested in seeing a presentation from an insurance company to learn what else they offer.”

When the HR Director left, another woman replaced her. That’s precisely when Joe took over the account. Because of the training he had taken on How to Sell to Women and his experience, he was well aware that when selling to women, he had to adapt his selling style to her needs.

The new HR director met with him. When he delivered his presentation to her, she was so impressed that she herself enrolled. She even asked him to meet with her daughters, and immediately scheduled a presentation for her employees.

In total, Joe presented to thirty-two employees. Twenty-six were women. He knew how to build rapport with women, and he also knew he would have to leave a good deal of time for answering questions. The result: twenty-six enrolled, two more said they would enroll in the next two months, when they get their finances in order, and the remaining four were not interested. Interestingly, three of the four that were not interested were men.

What Joe Knew About How to Sell Insurance and Financial Services to Women

- How to establish a connection with women

- The importance of being a truly genuine person

- He needed to apply a soft approach to selling (“Pushy people have no pull when selling to women!”)

- He had to take longer to explain things and answer all of their questions· He applied words and phrases that never made them feel uneducated (“Many people ask me the same question.”)

- If he truly cared about his clients and potential clients, it would come across. He cared!

- He had to share “Real World” examples of how his clients have benefited by obtaining his guidance.

These were the key factors that influenced many of them to enroll in supplemental insurance, life insurance, and other financial services offered by his company. He has also become the trusted advisor for the HR Director, her daughters, and many other employees.

Knowing how to sell insurance and financial services to women paid off. The company has completely shifted its attitude. Now, he comes in once a month to present to new employees, and Joe’s client base is consistently growing. His company even calls upon him to train other agents!

Knowing how to sell to women involves a great deal more. To purchase the book – visit https://www.howtoselltowomen.us/how-to-sell-to-women-book/